SG Publications: ‘The Lehman Minibonds crisis and financialisation of investor subjects in Singapore’ by Karen Lai, Area

August 30, 2013

In this paper Karen Lai (Geography) examines how the recent global financial crisis elicited uneven consequences for Singaporean investors.

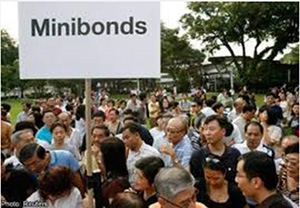

Using the case of the Lehman Minibonds crisis in Singapore, this paper aims to elucidate processes of financialisation and geographies of investor subjects by investigating the reshaping of retail banking consumers into investor subjects. Instead of painting all investor subjects with a broad brush as part of a generic financialisation process, the Minibonds crisis demonstrates how the consumption of financial products is geographically specific and moderated by local factors, such that financial subjects are incorporated unevenly into global financial markets. In the case of Singapore, Lai shows the process of how over many years everyday workers were encouraged to become responsible and knowledgeable investors who could secure their financial futures by engaging with financial markets. However the demographic variability of the investors in the Minibonds case resulted in disparate outcomes in terms of loss and compensation. Greater geographical sensitivity is therefore needed to tease out how distinctive groupings or ecologies of financial knowledge, practices and subjectivities emerge in different places with uneven connectivity and unequal material outcomes. The paper concludes by discussing the incomplete and contingent nature of subject formation and implications for understanding neoliberal subjectivities.

Lai, Karen P.Y. (2013), ‘The Lehman Minibonds crisis and financialisation of investor subjects in Singapore, Area, Vol. 45, No. 3, pp. 273-282.