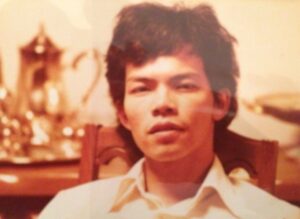

Chew Soo Hong

Chew Soo Hong grew up in Singapore and obtained his doctorate from the University of British Columbia in 1981. He had appointments in Hong Kong and the US before returning to Singapore in December 2009, where he joined the NUS Economics Department. While Professor Chew formally retired in 2022, he is still very much involved in research and has a continuing stream of new research papers that will put many of his younger colleagues to shame. Chew Soo Hong grew up in Singapore and obtained his doctorate from the University of British Columbia in 1981. He had appointments in Hong Kong and the US before returning to Singapore in December 2009, where he joined the NUS Economics Department. While Professor Chew formally retired in 2022, he is still very much involved in research and has a continuing stream of new research papers that will put many of his younger colleagues to shame.

Chew is one of the world’s foremost experts on economic models of decision-making. His first published paper (entitled “A Generalization of the Quasilinear Mean with Application to the Measurement of Income Inequality and Decision Theory Resolving the Allais Paradox” Econometrica, 1983) is one of the earliest to propose an alternative to the paradigmatic expected utility model established by John von Neumann and Oskar Morgenstern. Chew’s paper proposes a weakening of the independence axiom that underpins the expected utility model; the new axioms laid out in that paper allow for a more flexible model that could accommodate widely observed choice behavior excluded by expected utility (such as behavior of the type highlighted by Maurice Allais). Since then, Chew has gone on to explore other aspects of decision-making important to economists (such as temporal choice and mechanism design) and his research has embraced other methodologies beyond mathematical modeling, including experiments, neuro-imaging and genetic studies. |

Tell us a bit about your early life and its effect on your intellectual development.

Since before going to school, drawing and piano playing came naturally to me. Thanks to my mother, I went to a Chinese school and was quickly attracted to science and mathematics. Like many kids, Einstein was my idol. In Primary 5, I wrote about wanting to be a scientist for my first composition under “My Aim”. That was also the year when the school started to adopt English texts for science and math subjects while instruction remained in Chinese. This contributed to my switch to an English school at age 14. By the time I finished school at 18, I was effectively bilingual and perhaps also bicultural. This aspect of my school education in Singapore – a form of yuan (缘) – has had a profound influence on my intellectual development. Little did I know that I would grow into an economic scientist.

How did you first become interested in economics? And in decision theory, in particular?

Despite economics being the most popular 4th subject for A level students doing physics and double math, I chose art instead. My yuan (缘) with economics emerged years later when I was 23, several days after arriving at UBC to begin doctoral studies in applied math. My institute director asked me to explain my seemingly eclectic choice of classes – information theory from EE, AI from Computer Science, optimal control from Math, and gravitation from Physics. He asked pointedly, “Why gravitation?!”, and seemed distinctly unimpressed by my answer, “Relativistic physics is my intellectual first love”. He then explained that knowledge shopping through classes was an undergrad privilege and impressed upon me the need, as a PhD student, to develop a focus to build an academic career. He further shared his sense about the increasing “scarcity” of exciting challenges in theoretical physics compared to the days of Einstein and Schrödinger. He stressed his hope to see me leave UBC in three years and expressed concern that I might actually exemplify the archetype of a “professional grad student”, enjoying the pursuit of eclectic knowledge for its own sake … way past my 5th year.

I dropped gravitation! I then traversed the campus looking for something to fill the gap. One evening, quite by accident, I noticed an MBA micro class and sat in. I was struck by how much the optimization orientation of the subject matter sounded like the physics of human behavior! Having missed the first semester, I enrolled in the doctoral micro sequence in the reverse order. I next took two concurrent classes, one on uncertainty economics and the other on information choice which was offered by an accounting professor who assigned, in the take-home final, the Allais paradox as discussed on page 103 of Savage’s (1954) The Foundations of Statistics. I was quite captivated by Savage’s description of his having made a decision error in falling for the paradox and how he corrected himself using his sure-thing principle. Reflecting how sensible this allegedly “irrational” behavior seemed to me, I immediately set out to develop an axiomatic generalization of expected utility, something which has engaged much of my intellectual energy to this day. My fate as an economic scientist through decision theory was sealed or perhaps unsealed.

|

| If you don't wish to rely on miracles you need to buy insurance. The study of insurance markets is one of the many areas in economics where expected utility theory plays a crucial role. (Monk Nichiren Calming the Stormy Sea; woodblock print by Utagawa Kuniyoshi (circa 1835).) |

How has your research in decision theory evolved over time?

I am driven by a basic curiosity about how people make decisions in the presence of uncertainty. In the beginning, my approach was based on identifying axioms on the decision maker’s preference over lotteries and deriving their implications on observable choice. My work has helped to spawn a new direction of research on axiomatic non-expected utility theories. Over the years, my interest has progressed to encompass temporal decision making involving the timing of uncertainty resolution as well as preference over sources of uncertainty (which, among other things, can shed light on the nature of home bias in financial economics).

More recently, I have been working on the neurobiological underpinnings of human decision making. I am particularly interested in the interaction between top-down attention (which is conscious and goal-directed) and bottom-up salience (which is unconscious and stimulus driven). I think this research holds promise in delivering a unifying approach to modeling decision making under limited attention, which is an unavoidable feature of decision-making in today’s stimuli rich environment.

What advice would you give researchers at the beginning of their careers?

Rather than advice, perhaps it is more appropriate to share experience. In my intellectual and academic journey, I have been accompanied by a mindset which may be summarized by “being true to one’s heart”. Here, I have in mind the essential quality of “innocence” which comes through rather visually in the Chinese expression 赤子之心. In facing an uncertain and possibly turbulent future, discovering and relying on one’s heart of innocence – filled with wonderment even of the most mundane and encompassing hope and aspiration more so than anxiety or fear – may lend us a measure of stability, even steadfastness, as we begin our careers.

|

Decision Making Over Risky Alternatives Suppose an individual is presented with Option A, which gives him 400 dollars for sure and Option B, which is a gamble where he gets nothing with probability half and 1000 dollars with probability half. How should someone choose between these two options? One way of choosing is to work out the expected value of the alternatives. The expected value of Option A is 400 while it is 500 dollars for Option B. By that criterion, Option B is more attractive but it is clear that not everyone will pick B since it is also more risky and a person who chooses B could walk away with nothing. Expected utility theory posits that each person behaves as though he has a utility function defined on the monetary prizes and evaluates gambles by its expected utility. So one person with utility function U prefers Option B to A because 0.5U(0)+0.5U(1000) is bigger than U(400) whereas another person, with a different utility function V, will prefer Option A to option B because V(400) is greater than 0.5V(0)+0.5V(1000). (For example, choose V to be the square-root function.) The axiomatic foundations of expected utility theory were laid out by John von Neumann and Oskar Morgenstern in the 1940s. The use of this theory in economic and financial modeling is pervasive. An important part of research in decision theory consists of developing and testing alternatives to expected utility theory. Besides Chew Soo Hong, other economists in NUS who have carried out research in this area include John Quah and Zhong Songfa. |

CSH, JQ, February 2023